Top News

IRS Confirms Rights of Whistleblowers After Allegations Against Biden Family, DOJ

IRS Commissioner Daniel Werfel confirmed the rights of agency whistleblowers to make protected disclosures to Congress following attacks from Hunter Biden’s attorney on recent IRS whistleblowers’ allegations.

In June, Hunter Biden’s lawyer, Abbe Lowell, who represents high-profile individuals engulfed in political scandals, sent a letter to Republican investigators that questioned the legitimacy of IRS whistleblower allegations against the Department of Justice’s (DOJ) probe into Hunter Biden.

Daniel Werfel testifies before the Senate Finance Committee during his confirmation hearing to be the Internal Revenue Service Commissioner, Feb. 15, 2023, in Washington. (AP Photo/Mariam Zuhaib)

Lowell claimed IRS whistleblower transcripts recorded by House Ways and Means Committee Chair Jason Smith (R-MO) were “feed[ing] the misinformation campaign to harm our client … as a vehicle to attack his father.”

“Your attempt to protect the IRS agents was a transparent effort to provide cover to those with a bias and an axe to grind so deep and sharp as to have allowed them to avoid answering for their own conduct under oath,” he added.

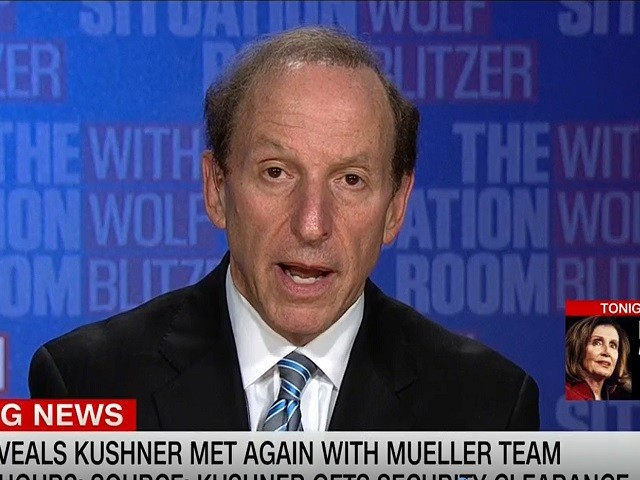

Abbe Lowell on 5/23/18 “Situation Room”

According to IRS Commissioner Werfel’s memo, IRS employees are “encouraged” to blow the whistle. “As employees, you are the first line of defense to call out issues that raise concerns, and I want it to be clear that we will always encourage a ‘see something, say something’ philosophy,” he wrote:

And in the event that you believe that the best course of action is not to raise issues up your IRS chain of command, but to raise the issue with an independent authority, there are a number of different options for raising concerns, including but not limited to:

- Treasury Inspector General for Tax Administration (TIGTA)

- Relevant Oversight Committees of the U.S. Congress

- U.S. Office of Special Counsel (OSC); and/or

- U.S. Department of Justice Office of Inspector General

The option(s) you may choose for reporting whistleblower concerns depend on the circumstances of a given matter. We have received questions from employees on what the right approach is if the issue to be reported might include taxpayer information protected by Section 6103 of the IRC or information protected by Federal Rule of Criminal Procedure 6(e).

RELATED VIDEO — Joe Biden Snaps at Reporter over “Big Guy” Question: “Why’d You Ask Such a Dumb Question?”:

The letter comes as IRS whistleblowers leveled at least 13 damning allegations against the DOJ’s probe into Hunter Biden.

Among the allegations, they allege Assistant U.S. Attorney Lesley Wolf refused to allow investigators to ask about Joe Biden being “the big guy,” the DOJ twice prevented United States Attorney David Weiss from bringing stronger charges against Hunter Biden, Attorney General Merrick Garland refused to name a special counsel in the tax investigation, which could have provided a degree of separation between Joe Biden and his DOJ, and the IRS recommended charges against Hunter Biden that were not approved by Garland.

Follow Wendell Husebø on Twitter @WendellHusebø. He is the author of Politics of Slave Morality.

Read the full article here

-

Uncategorized6 days ago

The Surge of Crypto Slots: A New Period in Online Pc Gaming

-

Uncategorized6 days ago

Kəşf Etmək Binance Coin Kazino Saytları Dünyasını

-

Uncategorized6 days ago

The Increase of Dogecoin Casino Sites: An Extensive Introduction

-

Uncategorized6 days ago

High Roller Online Casinos: Inside the Globe of Elite Betting

-

Uncategorized2 days ago

The Comprehensive Overview to Tutoring Networks