Top News

China’s economic crisis is still getting worse

Hui Ka Yan, the billionaire who runs China’s Evergrande property development company, has been put under police surveillance.

Hui was taken away by Chinese police earlier this month and is being monitored at a designated location, the people said, asking not to be identified because the matter is private.

It’s not clear why Hui is under so-called residential surveillance, a type of police action that falls short of formal detention or arrest and doesn’t mean Hui will be charged with a crime. Still, the measure means he is unable to leave the location, meet or communicate with others without approval, based on China’s Criminal Procedure Law. Passports and identification cards must be handed to police but the process shouldn’t exceed six months, according to the law…

Once considered among the most politically connected businessmen in China with ambitions ranging from electric cars to soccer, the tycoon has now become the most high-profile casualty of President Xi Jinping’s crackdown on excessive leverage and speculation in the real estate sector.

The security around Hui comes as his company missed another bond payment this week, creating more jitters for investors who are owed more than $300 billion.

Hengda Real Estate, Evergrande’s flagship unit in mainland China, missed principal and interest payments on Monday on an onshore 4 billion yuan ($547 million) bond, the company said in a filing to the Shenzhen Stock Exchange…

News that it had missed another payment rattled investors, who had already been fretting about the fate of the property giant after it warned Sunday that attempts to restructure its debt were in trouble because of a regulatory probe into Hengda.

If Hengda is unable to restructure its debt, which now seems likely, it’s facing either bankruptcy or liquidation. Meanwhile, the situation is also looking grim for Country Garden, a rival developer that has so far avoided defaulting on any payments. However, Country Garden has two payments due today.

The builder had two offshore bond interest payments due Wednesday: $40 million for a note maturing in January and 7.81 million ringgit ($1.66 million) on a Malaysian security maturing in 2025, according to data compiled by Bloomberg. The payments have respective grace periods of 30 and five days.

Any payment failures could send fresh shockwaves through the country’s property market that authorities have been trying to stabilize amid a years-long debt crisis…

While Country Garden has so far avoided defaulting, investors remain doubtful about its ability to survive China’s real estate crisis that shows no signs of abating. Last week, the company missed an initial deadline to pay $15.4 million of interest on an offshore note.

Meanwhile, China’s relationship with foreign investors also continues to get worse. The Economist reported yesterday that both the business people and their money have stopped showing up.

Business travel, which ground to an almost complete halt in 2022 as China issued few visas and required up to three weeks of quarantine, is far below Chinese expectations and increasing only at a snail’s pace. Harrington Zhang and colleagues at Nomura warn in a recent report (published before their colleague’s predicament came to light) that the “lack of business contacts and civilian exchanges between China and the outside world may have more profound implications for China’s economic growth potential in the years ahead”. Already foreign direct investment collapsed to $4.9bn in the second quarter, down by 94% from the same period in 2021. Just $4.4bn in foreign venture capital flowed into China in the first half of the year, down from about $55bn for all of 2021, according to PitchBook, a data provider.

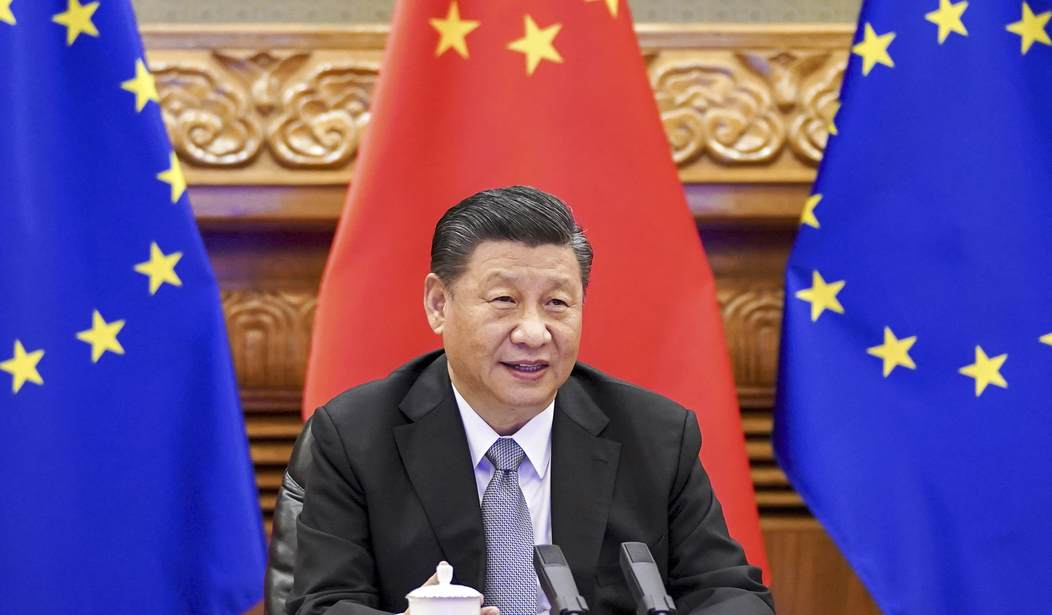

All of this must be creating a sense of growing panic at the top. After all, if China’s economy is on the decline, there is no one else to blame but President Xi and we can’t have that. Perhaps that’s why Xi reportedly used a word today that we haven’t heard from him in a while: “Reform.”

China’s top leadership gathered and took a long, hard look at the rules of the World Trade Organization on Wednesday. Afterward, President Xi Jinping used a word that he has not touched on for a few months: reform.

At the Politburo group study session, Xi also reiterated that China needs to be more proactive in playing by international trade rules while doing more to open up to the rest of the world – addressing two persistent gripes among much of the international community.

“This year marks the 45th anniversary of China’s reform and opening up. We must continue it to open the door wider and steady the reforms,” Xi said, adding that the country must “further generate import potential, loosen market access, deepen multilateral and bilateral cooperation, and improve its attractiveness to foreign capital”.

Just to put this in perspective, back in March the Wall Street Journal published a story titled “Xi Jinping Brings China’s Reform Era to an End.”

“Xi is restoring much of the Mao model in which the party manages the economy and ideological loyalty trumps professional competence,” said Susan Shirk, a former American diplomat and author of “Overreach,” a new book about how China risks derailing its peaceful rise.

The generational change reflects Mr. Xi’s priority on fortifying the Chinese system against a prolonged period of tension with the U.S.-led West, a contrast with the Deng era, which focused on building ties with the developed world…

Early in his tenure, Mr. Xi celebrated the reforms started by Deng. He started switching gears in the wake of a 2015 stock-market crash, growing more suspicious of market forces and embarking on a gradual return to absolute party control, including inserting the party into the corporate governance of both Chinese and foreign companies.

It’s too soon to tell if today’s comments about reform represent a real change of course or just a PR effort in response to bad economic news and growing desperation. If I had to guess I’d say it’s the latter based on the indications that Xi really is a communist ideologue who believes in the kind of central control that obviously benefits him most directly. Until he’s actually willing to open the country up and step away from the idea that China represents a communist rival to the western world, economic conditions will likely continue to deteriorate.

This 9-minute long BBC clip is a pretty good primer on the current situation.

Read the full article here