Top News

Bidenomics Update: Yowsahs – That’s Gonna Leave a Mark

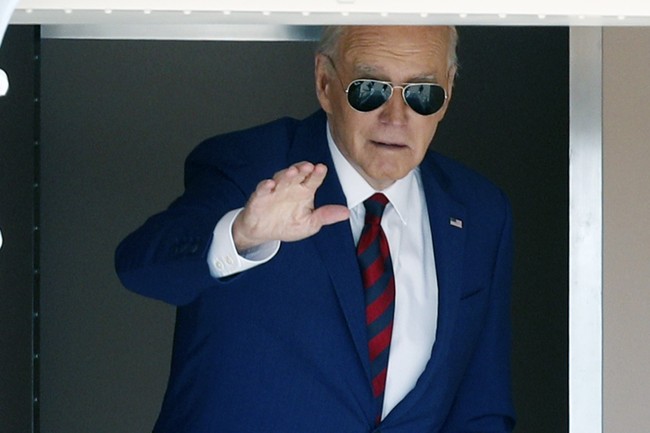

My friend John had a really good run-down of the meltdown over the inflation BOMB that hit POTATUS this morning. I mean, it’s gruesome and couldn’t happen to a nicer dementia-ridden grifter.

Inflation refuses to go away quietly. The CPI numbers out today are raising concerns that we may not see the soft landing we were hoping for.

Surging gas prices and sky-high mortgages and rent sent inflation rising more than expected in March, adding to Americans’ prolonged and painful battle with high costs. That could force the Federal Reserve to keep its punishing rates higher for longer.

US consumer prices picked up again last month, vaulting to a 3.5% increase for the 12 months ended in March, according to the latest Consumer Price Index data released Wednesday by the Bureau of Labor Statistics.

But it pretty much sucks for the rest of us out here who have to deal with the consequences.

What has been brutal but finally getting some much-deserved attention has been in the trending column over on X for the better part of the afternoon. It’s a real eye-opener laid out the way it is.

Just what exactly have the Biden years cost us so far?

Answer:

We all knew this but have continually had administration smoke blown up our asterisks about our lousy, ungrateful attitudes and our lying eyes.

I’m here to tell you what you already knew – it’s not COVID, it’s not Trump, it’s not even the Houthis.

Don’t blame anything or anyone but Joe Biden.

Inflation has not fallen in a single month since Biden’s term began (the closest was July 2022 when it was unchanged), which leaves overall prices up over 19% since Bodenomics was unleashed. And prices have never been higher. pic.twitter.com/Wt0zaCpTvN

— zerohedge (@zerohedge) April 10, 2024

This is going to cause his campaign a fair amount of indigestion, for which I am truly grateful. Being exposed yet again as frauds couldn’t happen at a better time for the country.

“We don’t have to get prices down because wages are….

hey, how bout that student loan forgiveness?” pic.twitter.com/WVi7IRKXKB— Frog Capital (@FrogNews) April 10, 2024

Also out today: Stress? What stress? #Bidenomics baby!

US credit-card delinquency rates were the highest on record in the fourth quarter, according to a Federal Reserve Bank of Philadelphia report.

Almost 3.5% of card balances were at least 30 days past due as of the end of December, the Philadelphia Fed said. That’s the highest figure in the data series going back to 2012, and up by about 30 basis points from the previous quarter. The share of debts that are 60 and 90 days late also climbed.

“Stress among cardholders was further underscored in payment behavior, as the share of accounts making minimum payments rose 34 basis points to a series high,” according to the report.

American consumers just don’t appreciate the guy enough. Why can’t they see what he’s done for them?

The CBS Evening News wasn’t doing any cheerleading tonight. They didn’t get the memo?

The market wigged because they’ve been planning on rate cuts, and those are fast sliding out of the picture. There were also some disturbing numbers buried deep under the report’s headline, which has heads shaking and some knees knocking.

The ‘supercore’ inflation measure shows Fed may have a real problem on its hands

A hotter-than-expected consumer price index reading rattled markets Wednesday, but markets are buzzing about an even more specific prices gauge contained within the data — the so-called supercore inflation reading.

Along with the overall inflation measure, economists also look at the core CPI, which excludes volatile food and energy prices, to find the true trend. The supercore gauge, which also excludes shelter and rent costs from its services reading, takes it even a step further. Fed officials say it is useful in the current climate as they see elevated housing inflation as a temporary problem and not as good a gauge of underlying prices.

Supercore accelerated to a 4.8% pace year over year in March, the highest in 11 months.

Tom Fitzpatrick, managing director of global market insights at R.J. O’Brien & Associates, said if you take the readings of the last three months and annualize them, you’re looking at a supercore inflation rate of more than 8%, far from the Federal Reserve’s 2% goal.

“As we sit here today, I think they’re probably pulling their hair out,” Fitzpatrick said.

My buddy Frog has a terrific chart that shows what Biden’s energy policies are doing compared to last year. He’s drained the Strategic Petroleum Reserve at will to artificially keep prices lower. He’s stomped on the liquid natural gas industry.

Take a look at the change here. I told you this was coming. Wow. https://t.co/TperxyEVfS pic.twitter.com/SRqYRdh3Xy

— Frog Capital (@FrogNews) April 10, 2024

So what does he do now that energy is trending up?

Oil is exploding higher, #inflation is re-accelerating: pic.twitter.com/ARz67gkbh2

— Sold At The Top (@soldatthetop) April 10, 2024

The cheap trick goodie bag is empty, and that POTATUS brain trust full of blowhard environmental ideologues always was.

If you take oil and gas and utilities and food and medical costs and rent/mortgage and clothing out of the equation… #inflation is akshually down. That’s #Bidenomics, folks.

— Daniel Turner (@DanielTurnerPTF) April 10, 2024

The man’s not wrong. People remember living good under Trump, if they weren’t outright living large – many for the first time in their lives. There was an undeniable, tangible sense of just being okay. Even if you couldn’t stand the Trump guy, life was alright, and that’s plenty.

Compared to now, it’s the golden glow of halcyon days in collective memories.

Yes, COVID was a good knock in the chops, but if POTATUS had had a competent team and a lick of intelligence himself, we might have come through this relatively unscathed.

When your ideological loyalties supersede your duty to the country, you wind up where we are.

And…wherever it is we’re headed at the moment.

Stop the train. I wanna get off until they get someone who knows how to drive this thing.

Read the full article here

-

Uncategorized1 day ago

The Surge of Crypto Slots: A New Period in Online Pc Gaming

-

Uncategorized1 day ago

The Increase of Dogecoin Casino Sites: An Extensive Introduction

-

Uncategorized1 day ago

Kəşf Etmək Binance Coin Kazino Saytları Dünyasını

-

Uncategorized1 day ago

High Roller Online Casinos: Inside the Globe of Elite Betting