Politics

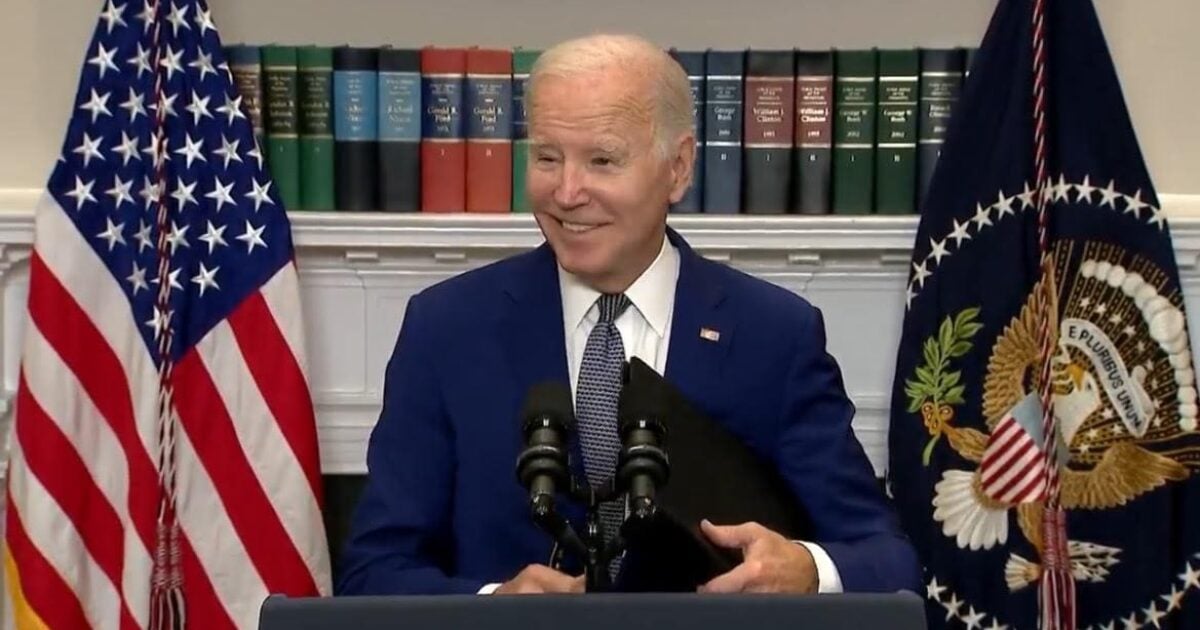

Joe Biden Unilaterally Cancels Student Loans For More Borrowers to Buy Votes

The Biden Regime will get their student loan bailout one way or another.

Joe Biden on Friday expanded his student loan bailout program to buy votes as the 2024 election season goes into full swing.

“From Day One of my Administration, I vowed to fix the student loan system and make sure higher education is a pathway to the middle class – not a barrier to opportunity. Already, my Administration has cancelled student debt for 3.6 million Americans through various actions – delivering lifechanging relief to students and families, and we created the most affordable student loan repayment plan ever: the SAVE plan.” Biden said in a statement.

The Biden Regime will cancel student loans for borrowers who took out less than $12,000 and have been in repayment for 10 years.

“Starting next month, borrowers enrolled in SAVE who took out less than $12,000 in loans and have been in repayment for 10 years will get their remaining student debt cancelled immediately,” Biden said.

Biden has used a series of workarounds to circumvent the Supreme Court’s decision to strike down his student loan bailout program.

Joe Biden unilaterally announced a massive forgiveness of student loans in August 2022 to buy the Gen Z-Millennial vote in the 2022 midterms.

Biden canceled over $400 billion in student loans which turned out to be up to $10,000 in student debt for borrowers who earn $125,000 a year or less and up to $20,000 for recipients of Pell Grants.

The Supreme Court ruled 6-3 against Joe Biden’s student loan relief program so the Department of Education rolled out a workaround forbearance program to cancel $39 billion in student loans by counting non-payments as payments for a period of time.

Only it isn’t your typical forbearance program. Borrowers won’t have to pay back ‘missed’ payments or make up the difference of ‘reduced’ payments. No interest will accrue on any of the missed payments.

Federal student loan payments were halted in March 2020 because of the Covid pandemic. Payments were set to resume in October 2023.

The Department of Education announced in October it is withholding $7.2 million from a student loan servicer over billing statement errors that affected 800,000 borrowers.

The DoE penalized the Missouri Higher Education Loan Authority for mailing out ‘late’ billing statements to 2.5 million borrowers as repayments resumed. 800,000 borrowers were put in forbearance and will not have to make payments until the problem is resolved.

Read the full article here