Finance

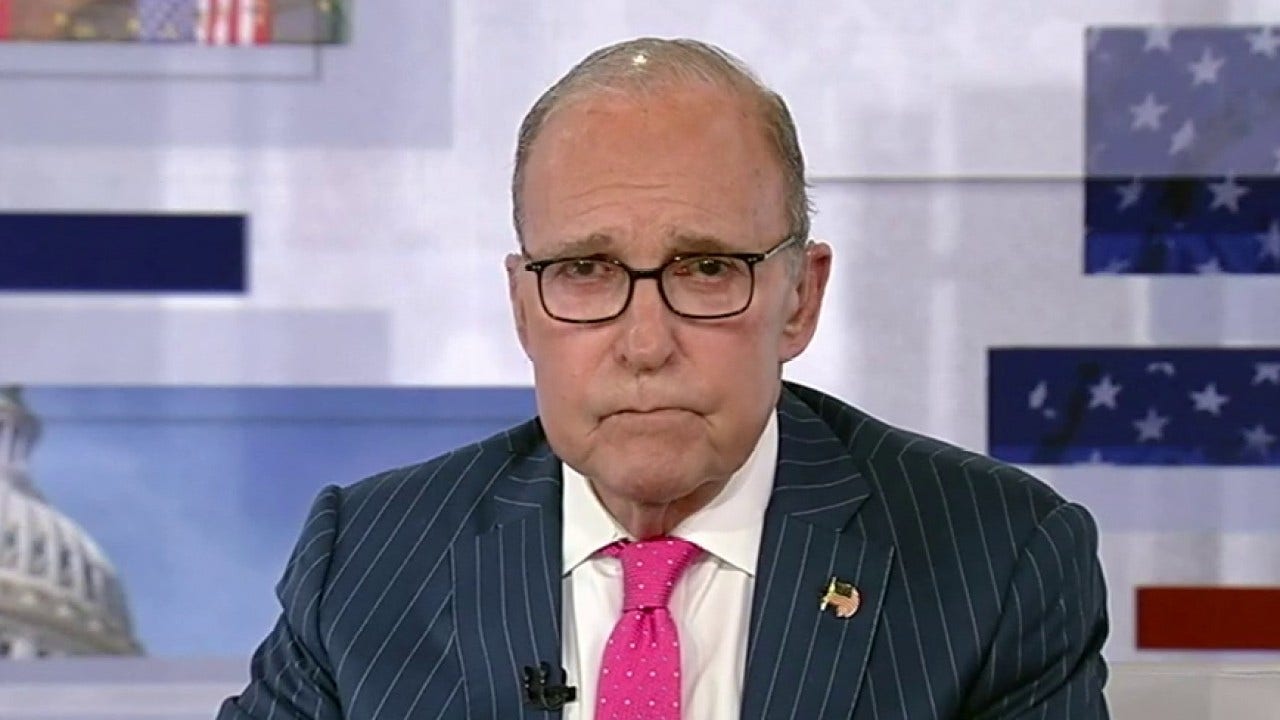

LARRY KUDLOW: The Biden-created affordability crisis is worsening

Joe Biden’s heavy-duty federal spending fiasco is forcing interest rates to rise and keeping higher than expected inflation alive. Biden has poured in almost $6 trillion in new spending and it looks like he’s planning on at least another $4 trillion in the years ahead, that is according to the new CBO baseline.

Bidenomics would move federal debt held by the public all the way to $48 trillion – from $26 trillion presently, as though that weren’t bad enough – as the share of GDP borrowing could reach 116% in the years ahead. That’s well over twice the fifty-year average of 48% of GDP.

So, you have the Fed trying to restrain inflation on the one hand, but the Biden administration’s huge spending and borrowing look to be increasing inflation once again. Today’s unexpected CPI increase of three-tenths of 1% – coming to 3.1% over the past year – now, that may not be a one-shot aberration.

THOUSANDS OF UBER, LYFT, DOORDASH DRIVERS TO STRIKE ON VALENTINE’S DAY TO DEMAND FAIR PAY

Over the past three months, core inflation, that is excluding food and energy, is up 4% at an annual rate. Remember, the Fed’s target is 2%. Jay Powell’s goofy inflation measure of core services excluding housing is actually up 6.7% annually over the past three months.

That’s the fastest rate in nineteen months. Meanwhile services inflation itself is rising 6.4% annually over the past three months and, just to add to it, the latest ISM survey of manufacturing prices just moved above 50% for the first time in ten months. These are not good numbers. They suggest inflation is creeping higher, not lower. Long-term bond rates spiked all the way to 4.3% – up 14 basis points. They’ve been shooting higher since the new year began.

All of the Bidens’ government spending gave a temporary boost to GDP, but now they’re paying the inflation piper. Actually, we are paying the inflation piper. Outsized price hikes continue to pop up all over the economy. Since Biden took office, groceries are up 20.8%. Energy up 29%. The CPI itself is up 18%.

Want more? Eggs up 37%. Gasoline up 33%. Baby food up 29%. Electricity up 28% and I could go on and on. With all these price hikes for live-a-day essentials, real average weekly earnings for typical families have fallen by 4.9% under “Bidenomics.”

That key measure under Trump rose $6,000 for families, or roughly 9%. Minus 4.9%, plus 9%. Now, that’s a contrast. So, folks, the moral of the story is you can’t spend your way into prosperity. All of a sudden, prices are going up again, interest rates are going up again and the Biden-created affordability crisis is worsening.

If it weren’t an election year, the Federal Reserve should probably be tightening their money and interest rate targets, but certainly not lowering them, that’s for sure. Like I said, money can’t buy you love.

This article is adapted from Larry Kudlow’s opening commentary on the February 13, 2024, edition of “Kudlow.”

Read the full article here