Finance

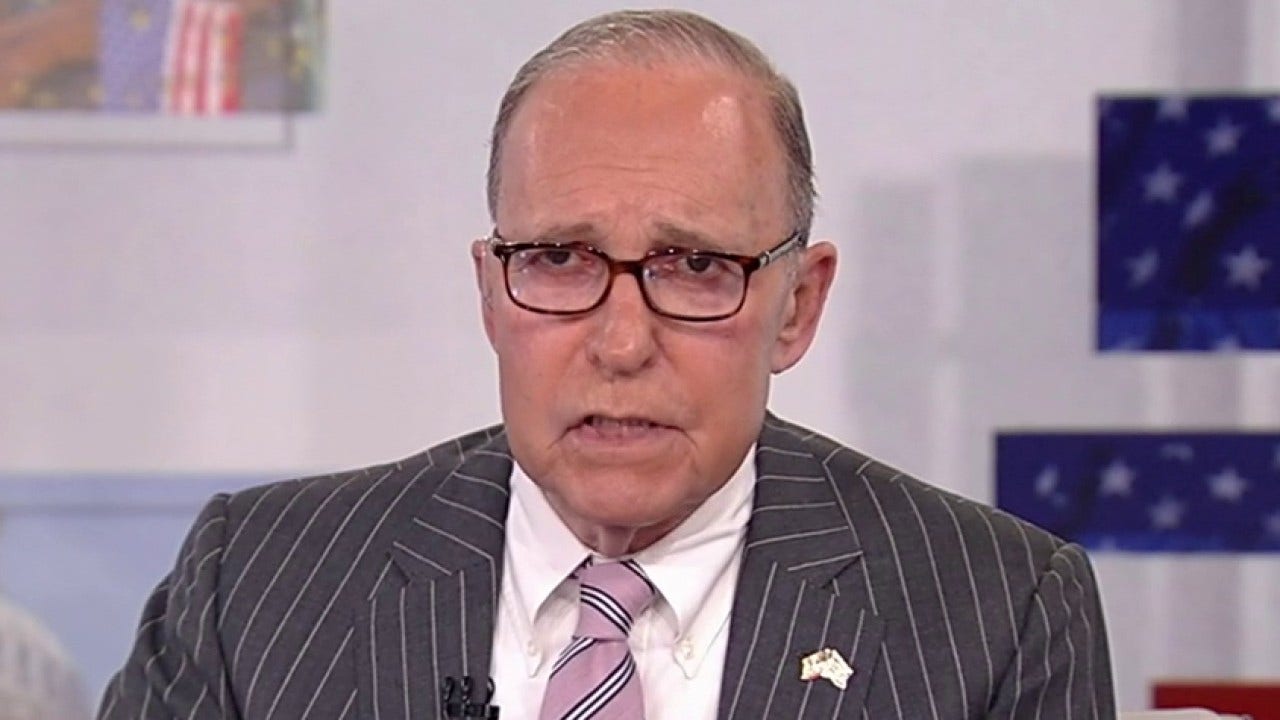

LARRY KUDLOW: Government spending, deficits and debt played into the GDP number

So, about that 3%-plus GDP growth rate reported yesterday that led to table-dancing in the White House… I’d give them their due. If you’re running a 30% economic approval rating on a consistent basis, it’s perfectly understandable that you get some good news and you’d throw a few back and jump on the tables. However, it’s important to emphasize the outsized role that government spending, deficits and debt played in that GDP number and, in fact, all of President Biden’s GDP numbers in recent years.

The Committee to Unleash Prosperity Hotline shows that government spending has grown faster than consumer spending for the last six quarters and, I might add, consumer spending lately has been heavily dependent on credit card borrowing, especially during the holiday season.

I noted yesterday that economist Joe Lavorgna has pointed out that government spending in the last three years under Mr. Biden has come in with a cumulative excess of $3.3 trillion above the long-term spending baseline, and that federal spending continues to rise faster than GDP.

BILLIONAIRE BOND KING QUESTIONS UNEMPLOYMENT DATA: ‘HARD TO BELIEVE’

Meanwhile, on the supply side of the economy, business equipment has been flat over the past year, as has been manufacturing output. The Bidens are pumping up demand by borrowing their keisters off, but there is no matching increase in the supply of goods and services.

No matter how much welcome easing of inflation in recent months we’ve seen, too much money chasing too few goods is a recipe for higher, not lower, inflation. Additionally, from ZeroHedge.com, while Q4 nominal GDP grew by $329 billion, the U.S. budget deficit grew by more than 50%, or $510 billion. What’s more?

U.S. debt in public hands during that same three-month period increased a remarkable $834 billion, or 154% more than the increase in GDP. So, ZeroHedge concludes (and this is good work on their part), it took $1.55 in budget deficit to generate $1 of growth, and it takes over $2.50 in new debt to generate $1 of GDP growth. I’d say: That’s a “helluva” way to make a living.

This article is adapted from Larry Kudlow’s opening commentary on the January 26, 2024, edition of “Kudlow.”

Read the full article here