Finance

Increasing mortgage rates in the US are putting growing pressure on homebuyers

Recent data shows 30-year fixed mortgage rates rose to their highest level in over 20 years, leaving plenty of homebuyers in a pinch.

The spike is forcing buyers to save up a lot more money to afford a home… Especially those who are looking to buy a house for the first time.

“We’re still continuing to rent and I think we will continue to rent until we see a good drop in the numbers,” said Shweta Sugnani, who’s looking to buy a house around western Washington.

MORTGAGE RATES LEAP TO 22-YEAR HIGH

Sugnani has been looking to buy for about two years.

She hasn’t had much luck and rising interest rates have limited what she’s able to afford.

“When it comes to working out the numbers, the high interest rates do play a big, if not the biggest part, in determining whether or not we can afford the house,” Sugnani said.

HOME INSURANCE COSTS ARE RISING: HERE’S WHY

According to Freddie Mac, the average rate for a 30-year fixed mortgage climbed above 7.2% in August, the highest level since 2001. This time last year, it was just over 5.5%.

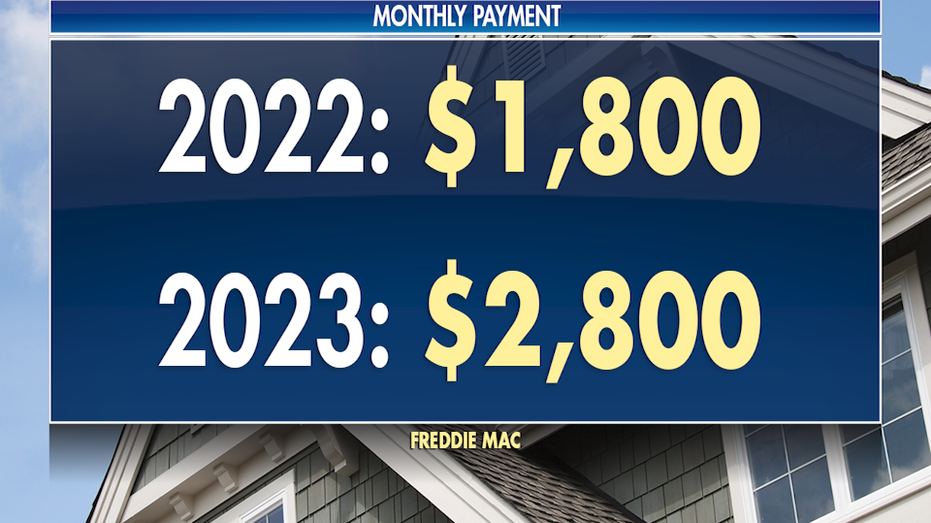

That means last year, a $400,000 mortgage would have cost around $1,800 a month. This year, it would be $1,000 more. The increase is putting buyers in a tough spot.

“Rates seem to be remaining high for the short term. So, I don’t see the situation improving in the next year all that much,” said Redfin Chief Economist Daryl Fairweather.

US PENDING HOME SALES PLUMMET AS HIGH MORTGAGE RATES TAKE A TOLL

Sugnani is willing to wait out the high interest rates… to an extent.

“I think we’re going to reach a point where we’re going to need a bigger house,” Sugnani said. “And at that point, I think we would consider buying… even if interest rates are slightly higher.”

According to Redfin, a lack of supply is also a problem. People who locked in lower interest rates during the pandemic aren’t looking to sell their homes as rates rise.

Read the full article here