Finance

GOP takes on Federal Reserve in battle over digital dollar

It’s been one week since Congress returned from summer recess and Republican lawmakers are wasting no time in bringing legislation back to the House floor to block a central bank digital currency, FOX Business has learned.

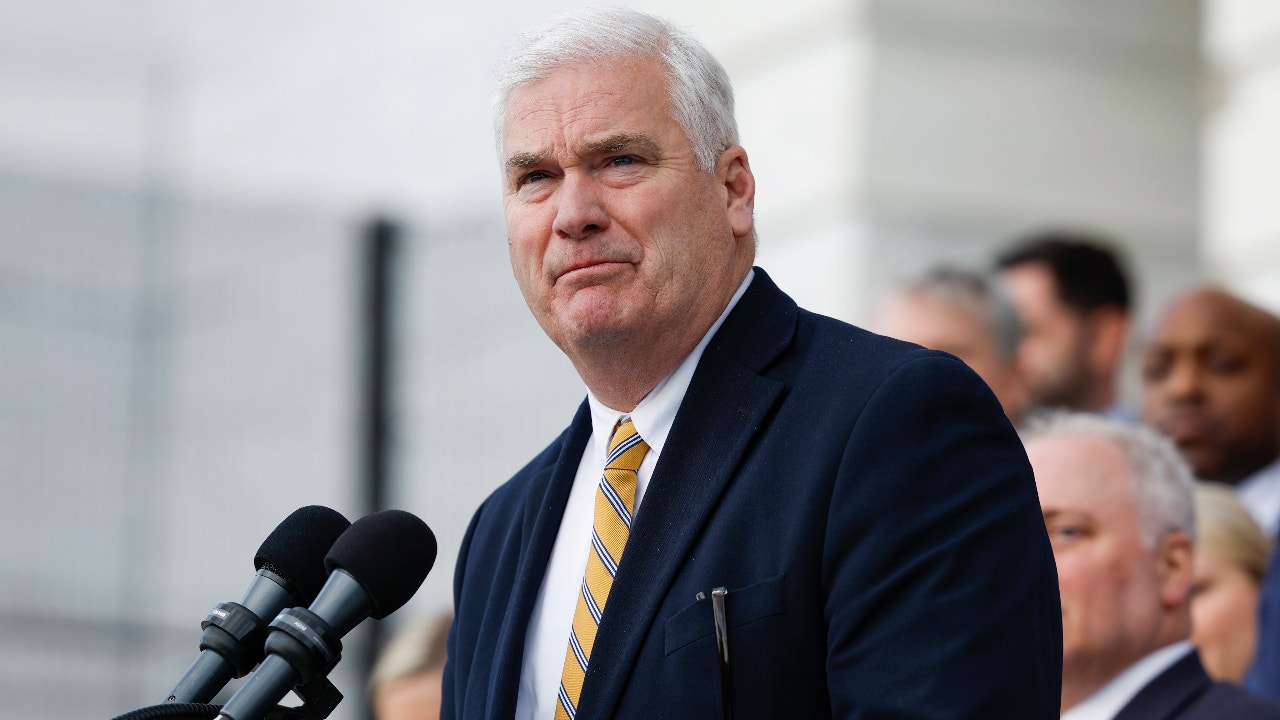

House Majority Whip Tom Emmer, R-Minn., on Tuesday afternoon will reintroduce the Central Bank Digital Currency Anti-Surveillance State Act, a Republican-backed bill that aims to prevent the Federal Reserve and its member banks from issuing a digital version of the dollar and using it to implement monetary policy.

Central bank digital currencies, more commonly referred to as CBDCs, have become increasingly popular over the last three years. As many as 130 countries, representing 98% of the global economy, are exploring digital versions of their currencies; 11 countries, including China, have fully implemented a CBDC.

BIDEN ADMINISTRATION PROPOSES CRYPTO TAX REGULATIONS IN NEW REFORM

However, CBDCs are controversial among crypto enthusiasts and conservatives even though they both fall under the category of digital assets. Traditional cryptocurrencies like bitcoin were created as a mechanism to avoid centralized government control; CBDCs, meanwhile, establish a monetary link between private citizens and the government.

Republicans like Emmer say a CBDC would enhance the surveillance state, which is why Communist China is among the first countries to establish one.

CHINA’S ECONOMY IS SICK AND COULD INFECT THE US

Governments can use CBDCs to gain unfettered access to private citizens’ financial data. The potential access to, and exploitation of user data significantly outweighs the benefits of low transaction costs and increased financial inclusion, critics say.

The official line from the Biden administration is that there are no plans to issue a CBDC, but GOP lawmakers are skeptical because the Fed has taken what’s seen as nascent steps like research and pilot programs to explore the possibility of one day implementing a CBDC. In fact, CBDCs have become a talking point among 2024 Republican presidential candidates Ron DeSantis and Vivek Ramaswamy. Democratic presidential hopeful Robert F. Kennedy Jr. has also denounced CBDCs, calling them “instruments of control and oppression.”

Emmer’s new legislation is actually an updated bill that he introduced earlier this year and is reissuing to reflect the fast-evolving digital asset policy landscape. It’s co-sponsored by 50 congressional Republicans and implements two main changes to the original text introduced in February. The new version contains a section that bans “intermediated CBDCs,” CBDCs that are issued by the Fed but managed by retail banks and other financial institutions instead of directly by the Fed. An intermediated CBDC is the model China uses for its digital yuan.

The latest bill has also removed a provision requiring the Fed to report to Congress any CBDC pilot programs or studies it conducts on the subject. According to Emmer, the change was made to make the bill more narrowly focused, as the issue is also being addressed in separate bills such as Rep. Alex Mooney’s Digital Dollar Pilot Prevention Act.

Anti-CBDC legislation has also been introduced in the Senate, with Mike Lee’s No CBDC Act and Ted Cruz’s bill, like Emmer’s, that would prevent the Fed from issuing a CBDC directly to individuals.

Because Democrats control the Senate and the White House, any anti-CBDC legislation is unlikely to pass this year. That said, people close to Emmer hope the legislation will raise public awareness to the downside CBDCs represent.

“The administration has made it clear: President Biden is willing to compromise the American people’s right to financial privacy for a surveillance-style CBDC,” Emmer told FOX Business. “That’s why I am reintroducing an improved CBDC Anti-Surveillance State Act to put a check on unelected bureaucrats and ensure the United States’ digital currency policy upholds our values of privacy, individual sovereignty, and free-market competitiveness.”

Spokespeople for the Fed and Treasury did not immediately respond to requests for comment.

The updated bill comes ahead of a House Financial Services subcommittee hearing on CBDCs on Thursday. Meanwhile, Securities and Exchange Commission Chairman Gary Gensler will testify today in front of the Senate Banking Committee where he’ll likely be questioned about his approach to digital asset regulation, which has been described as “hostile” by many industry participants. Gensler will also appear before the House Financial Services Committee later this month.

Read the full article here