Finance

Disney’s Bob Iger admits second stint as CEO more challenging than he expected

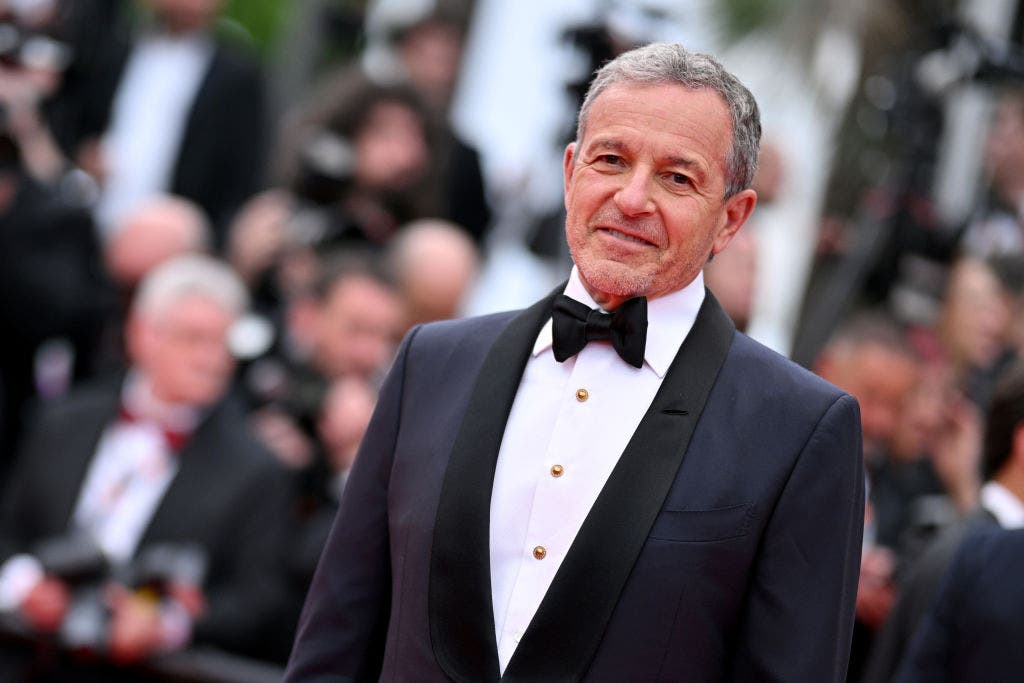

Disney chief executive Bob Iger acknowledged during a company-wide town hall Tuesday that his second stretch at the helm since returning a year ago has proven more difficult than he expected.

Iger made that admission to ABC News anchor David Muir, who moderated the event before Disney employees, and asked if the job has been more challenging than he had anticipated, according to multiple reports.

“I knew that there were myriad challenges that I would face coming back,” Iger said, according to Variety, and The Wall Street Journal reported the CEO continued, “I must say there were many more of them than I anticipated.”

He added, “I won’t say that it was easy, but I’ve never second guessed the decision to come back, and being back still feels great.”

DISNEY TURNS 100 AS CEO BOB IGER TRIES TO FIX MEDIA GIANT

According to Variety, Iger did not make any major announcements during the sit-down at New Amsterdam Theatre in New York, where he was joined by Disney Entertainment co-chairs Dana Walden and Alan Bergman, Disney parks chairman Josh D’Amaro, and ESPN chairman James Pitaro.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DIS | THE WALT DISNEY CO. | 92.49 | -2.67 | -2.80% |

The Journal reported Iger said he plans to build the “modern version of the Walt Disney Company” over the next year, but the CEO provided scant details. He also downplayed previous comments he made to CNBC over the summer about potentially selling off media assets.

Iger returned to the role of Disney CEO in November 2022, a position he previously held from 2005 to early 2020. Since his return, he has sought to “quiet the noise” in culture wars after his predecessor made moves that irked conservatives and sparked a high-profile political showdown.

DISNEY CEO BOB IGER VOWS TO ‘QUIET THE NOISE’ IN CULTURE WARS

Former CEO Bob Chapek took a public stand against a Florida bill that bars teachers from providing instruction on sexual orientation and gender identity in kindergarten through third-grade classrooms. That escalated into a battle with Florida Gov. Ron DeSantis, which resulted in the Republican-led state legislature revoking Disney World’s self-governing authority in the state, sparking legal actions from both sides that are ongoing.

Disney has also been embroiled in a battle with activist investor Nelson Petz, who faced off with company leadership in January.

In the board fight with Disney that kicked off 2023, Peltz said in a press release that the entertainment giant had lost its way over the course of recent years “resulting in a rapid deterioration in its financial performance from a consistent dividend-paying, high free cash flow generative business into a highly leveraged enterprise with reduced earnings power and weak free cash flow conversion.”

DISNEY FACING ACTIVIST INVESTOR NELSON PELTZ AGAIN

Disney pushed back on Peltz’s claims, arguing in a regulatory filing that he “does not understand Disney’s businesses and lacks the skills and experience to assist the board in delivering shareholder value in a rapidly shifting media ecosystem.” The company also said the hedge fund’s analysis of its financial transactions was flawed.

It is recently-released fourth-quarter financial results, Disney reported overall revenue for the three-month period of $21.24 billion and net income of $246 million.

“While we still have work to do to continue improving results, our progress has allowed us to move beyond this period of fixing and begin building our businesses again,” Iger said during an earnings call earlier this month.

At the time, he identified hitting “sustained” profitability in streaming business, turning ESPN into a “preeminent digital sports platform,” making improvements at its film studios and “turbocharging” growth in its Experiences segment as four “key building opportunities.” Its parks and cruises fall under the Experiences segment.

The entertainment giant indicated earlier this month it would trim $2 billion more in costs, raising its annual savings goal to $7.5 billion.

Disney shares have gained over 10% this year, behind the S&P 500’s 18%+ rise.

FOX Business’ Eric Revell and Aislinn Murphy contributed to this report.

Read the full article here