Finance

Biden administration releases latest student loan plan after SCOTUS blocks handout: What to know

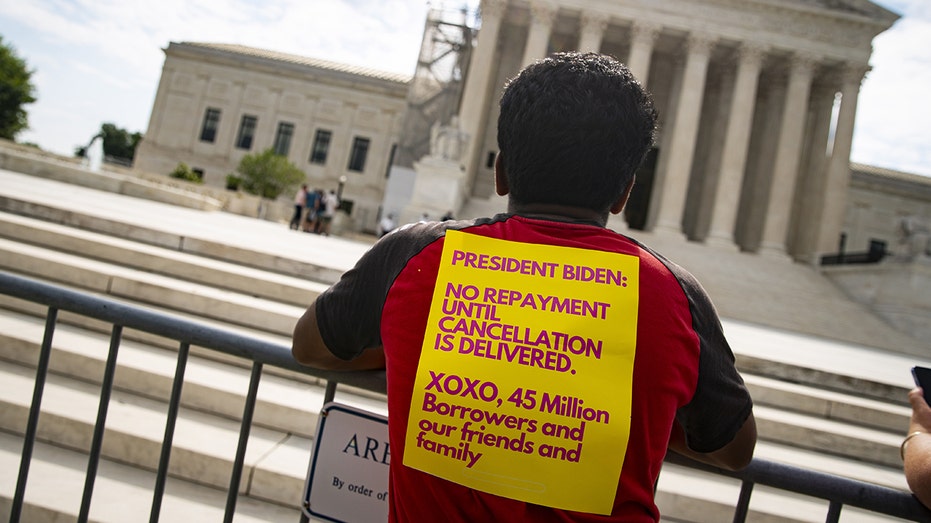

The Biden administration on Friday announced a new student loan debt initiative following the Supreme Court’s decision blocking his more than $400 billion handout plan to wipe away $10,000 to $20,000 in debt for student loan borrowers.

After the Supreme Court decision was issued, the Dept. of Education announced that it will revise its new income-driven repayment (IDR) plan to reduce borrowers’ payments and provide an “on-ramp” intended to help borrowers struggling to resume repayment.

“Earlier today, the Department of Education finalized our new income-driven repayment plan, Saving on A Valuable Education (SAVE), which will be the most affordable repayment plan in history,” Secretary of Education Miguel Cardona said in a statement. “It will cut monthly payments to zero dollars for millions of low-income borrowers, save all other borrowers at least $1,000 per year, and stop runaway interest that leaves borrowers owing more than their initial loan.”

“Finally, the Department is providing a 12-month on-ramp transition period that will help ensure borrowers smoothly and successfully return to repayment without falling into delinquency or default. Borrowers who can make payments should do so as payments will resume and interest will accrue, but the on-ramp to repayment will help borrowers avoid the harshest consequences of missed, partial, or late payments like negative credit reports and having loans referred to collection agencies,” Cardona added.

SUPREME COURT RULES AGAINST BIDEN STUDENT LOAN DEBT HANDOUT

The Education Department’s SAVE plan will revise the existing Revised Pay-As-You-Earn (REPAYE) income-driven repayment plan when it takes effect. Borrowers who are enrolled in the REPAYE plan will be automatically transitioned into the SAVE plan without having to take any action.

Several changes to the IDR plan will take effect this year before the end of the student loan repayment pause, although the regulation is scheduled to take full effect on July 1, 2024.

Among the changes in the meantime before repayment resumes will be an increase in the amount of income protected from repayment calculations, as the protected income threshold will rise from 150% of the federal poverty guidelines to 225%. The Education Dept. estimates this means a single borrower earning less than $32,805 annually (or $67,500 for a family of four) won’t have to make payments, and that the change will make 1 million additional borrowers eligible for a $0 payment.

STUDENT LOAN REPAYMENTS SET TO RESUME SOON REGARDLESS OF SCOTUS RULING

Borrowers who aren’t eligible for a $0 payment would save “at least $1,000 a year compared to the current REPAYE plan,” according to the Dept. of Education. The agency says a single borrower would save $91 a month, or $1,080 per year, while a family of four would save $187 monthly and $2,244 per year.

Additionally, the Dept. of Education will stop charging monthly interest that isn’t covered by the borrower’s payment on the SAVE plan – effectively preventing borrowers’ loan balances from growing due to unpaid interest.

It will also stop requiring married borrowers who file separate tax returns from including their spouse’s income or their family size in their payment calculation under the SAVE plan.

STUDENT LOAN REPAYMENTS COULD SLAM BIG-NAME RETAILERS THIS FALL

When the SAVE plan is fully implemented in July 2024 several other changes will take effect – including a reduction in payments on undergraduate loans from 10% to 5% of incomes above 225% of the federal poverty line.

Borrowers with undergraduate and graduate loans will be allowed to pay a weighted balance of between 5% and 10% of their income based on the original balances of their loans. As an example, the Dept. of Education explained that a borrower with $20,000 in undergraduate loans and $60,000 in graduate loans would pay 8.75% of their income, as one-quarter of the balance would be at the 5% undergraduate threshold and the remaining three-quarters at the 10% graduate level.

Borrowers who originally had smaller balances – defined by the agency as $12,000 or less – will be eligible for forgiveness of their remaining balances after 120 payments, or the equivalent of 10 years in repayment. An additional 12 payments will be added to that figure for each additional $1,000 borrowed above that level up to a maximum of 20 years for undergraduate loans and 25 years for graduate loans.

Currently, IDR plans require all borrowers to repay loans for at least 20 to 25 years before receiving forgiveness.

The Education Dept. announced a virtual public hearing on July 18th on the changes and is soliciting written comments from stakeholders.

Student loans were mostly nationalized in 2010 in Obamacare-related legislation. The cost of college tuition rose more than 30% in the decade from 2010 to 2020 according to numerous studies, well beyond the pace of inflation during the same time period.

Read the full article here