Finance

Aretha Franklin’s sons battle over late singer’s estate

Aretha Franklin’s four sons are battling over her estate five years after her death.

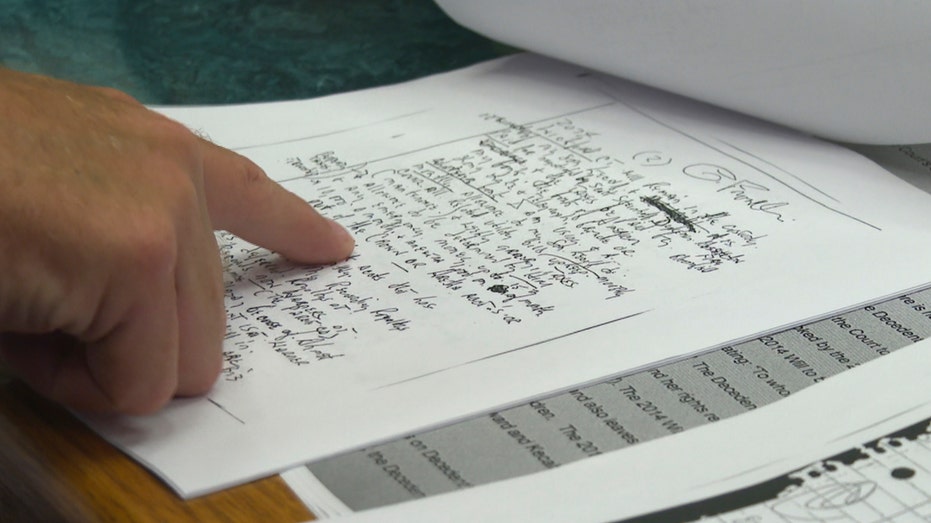

A strange trial will begin Monday with Franklin’s assets being called into question. Two handwritten wills are set to be presented, which under Michigan law, can be accepted as her final commands.

Both of the wills were discovered in her Detroit home in the months following her death from pancreatic cancer in 2018 – with the more recent one being found in a notebook between couch cushions.

The dispute is pitting one son against his siblings. Ted White II believes papers dated in 2010, which was found in a cabinet, should mainly control the estate, while Kecalf Franklin and Edward Franklin favor a 2014 document.

DETROIT LAWYER TAPPED TO TAKE OVER ARETHA FRANKLIN ESTATE

It was immediately known that Franklin had died without a will, which meant her four sons likely would share assets worth millions, including real estate in suburban Detroit, furs, gowns, jewelry and future royalties from her works. A niece, Sabrina Owens, agreed to be personal representative or executor.

There are differences between the documents, though they both appear to indicate the sons would share income from music and copyrights, which seems to make that issue less contentious than a few others.

The older will lists White and Owens as co-executors and says Kecalf and Edward “must take business classes and get a certificate or a degree” to benefit from the estate.

However, the 2014 version crosses out White’s name as executor and has Kecalf in his place. There is no mention of business classes. Kecalf and grandchildren would get his mother’s main home in Bloomfield Hills, which was valued at $1.1 million when she died, but is worth much more today.

Franklin wrote in 2014 that her gowns could be auctioned or go to the Smithsonian Institution in Washington, D.C. She indicated in both papers that oldest son, Clarence, who lives under a guardianship, must be regularly supported.

For five years, Franklin’s estate has been handled at different times by three executors. Owens quit in 2020, citing a “rift” among the sons.

Overall assets were pegged at $4.1 million, mostly cash and real estate, though Franklin’s creative works and intellectual property were undervalued with just a nominal $1 figure.

The estate since 2020 has paid at least $8.1 million to the Internal Revenue Service, which, court filings show, had a claim for taxes after the singer’s death.

The Associated Press contributed to this report.

Read the full article here