Top News

Democrats Are Still Pushing a Wealth Tax

Earlier this month the White House published a “fact sheet” about President Biden’s latest budget plan. One of the items offered in that laundry list of proposals was this:

Requires Billionaires to Pay at Least 25 Percent of Income in Taxes. Billionaires make their money in ways that are often taxed at lower rates than ordinary wage income, or sometimes not taxed at all, thanks to giant loopholes and tax preferences that disproportionately benefit the wealthiest taxpayers. As a result, many of these wealthy Americans are able pay an average income tax rate of just 8 percent on their full incomes—a lower rate than many firefighters or teachers. To finally address this glaring inequity, the President’s Budget includes a 25 percent minimum tax on the wealthiest 0.01 percent, those with wealth of more than $100 million.

This description is intentionally misleading in a number of ways. First, the definition of “income” used here is not the one that has ever been used by the IRS in assessing taxes.

Biden proposes to raise $503 billion over the next decade by imposing a 25 percent tax on people who claim more than $100 million in assets — a source of wealth that has long been beyond the reach of the IRS. The new levy would be assessed not just on annual income but on the annual increase in the value of their holdings, including stocks and real estate, even if that additional value was not realized because those assets were not sold.

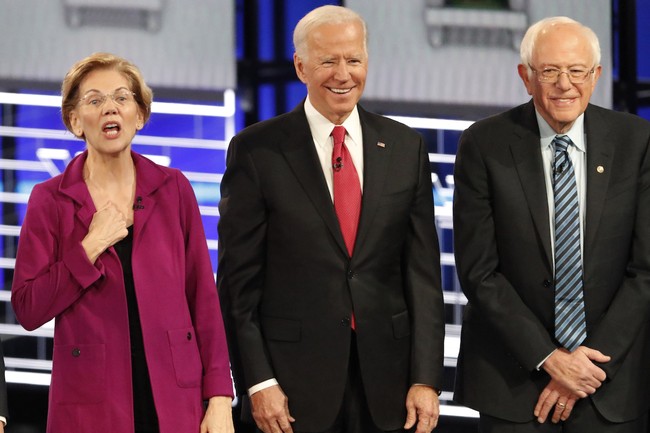

This is really just a wealth tax, something that progressives like Elizabeth Warren have been pushing for years. Also, the White House claim that wealthy Americans pay an average income tax rate of 8 percent is a lie which Biden has been telling since 2021. I wrote about it here but the short version is that the 8% is an estimate based on increased wealth and unrealized gains, not on income. In other words, this is an imaginary tax system that does not exist in the US.

Under our actual tax system, top earners pay a much higher percentage in taxes on their income than middle-class earners. But you don’t have to take my word, here’s what FactCheck.org said:

…the top-earning taxpayers, on average, pay higher tax rates than those in the income groups below them. The top 0.1% of earners, with more than $4.4 million in expanded cash income, pay an average rate of 25.1% in federal income and payroll taxes, according to the TPC chart. Those in the middle 20%, with income between $59,700 and $105,900, pay an average of 12.3%.

And here’s what the Washington Post’s Fact Checker said:

…if you check Treasury Department calculations for what the richest Americans already pay in taxes, you would see that the top 1 percent pay in excess of 20 percent in income taxes and more than 30 percent in all federal taxes. Even if you drill down to the top 400 wealthiest taxpayers — data that was publicly available on an annual basis until President Donald Trump killed the report — they paid an effective tax rate of 23.1 percent in 2014. These taxpayers — with $127 billion of income — that year paid $29.4 billion in income taxes, or more than 2 percent of all income taxes, the IRS said. That’s more than the bottom 70 percent of taxpayers combined.

Paying more than the bottom 70% is what Democrats call “not paying their fair share.” In any case, Biden’s claim about billionaires paying an 8% rate is a lie which he has been repeated for three years despite fact checks from every major news outlet pointing out that this is very misleading. In all, he’s made this dishonest claim more than 30 times.

Even setting aside all of the lying, there’s no evidence that a wealth tax would be practical or effective.

Many independent tax experts say such a levy would be almost impossible to enforce: The IRS would struggle to assess anyone’s total net worth, much less the complex fortunes of the ultrawealthy, they say.

“There’s never going to be a comprehensive database at the IRS of everybody’s assets,” said Garrett Watson, a researcher at the right-leaning Tax Foundation, who also cautioned that trying to tax assets as volatile as stocks would create a highly “unstable” source of federal revenue.

Moreover, any attempt to value assets would lead to billionaires finding new ways to hide those assets, said Eric Zwick, an economist and tax expert who teaches finance at the University of Chicago. Much simpler changes to the tax code could raise revenue from rich people without forcing the IRS to estimate unrealized gains, Zwick said, including reducing the deduction for business income claimed on personal tax returns — a tax break created in President Donald Trump’s 2017 tax cuts…

Senate Budget Committee Chairman Sheldon Whitehouse (D-R.I.) said he thinks it would be worth the IRS’s time to conduct the type of complicated investigations needed to collect a wealth tax. “While each [high-net-worth taxpayer] may take considerable effort to figure out what their unrealized gains are, the tax payments for doing that make it easily worthwhile,” he said.

The wealth tax has been tried out in Europe and it was a widely considered a failure.

Normally progressives like to point to Europe for policy success. Not this time. The experiment with the wealth tax in Europe was a failure in many countries. France’s wealth tax contributed to the exodus of an estimated 42,000 millionaires between 2000 and 2012, among other problems. Only last year, French president Emmanuel Macron killed it.

In 1990, twelve countries in Europe had a wealth tax. Today, there are only three: Norway, Spain, and Switzerland. According to reports by the OECD and others, there were some clear themes with the policy: it was expensive to administer, it was hard on people with lots of assets but little cash, it distorted saving and investment decisions, it pushed the rich and their money out of the taxing countries—and, perhaps worst of all, it didn’t raise much revenue.

There is only one way around the problem of billionaires leaving the country and that is to make the wealth tax global. That’s something that progressives are now looking at.

Finance officials from the world’s biggest economies began talks this week on introducing a global minimum tax on billionaires.

The representatives of the G20 countries discussed the proposal at a summit in São Paulo, Brazil, two years after a landmark agreement showed the world could act together in setting a minimum tax rate of 15% for multinational companies.

Biden’s political team clearly believes this wealth tax proposal is a winner but that’s only true if he’s able to continue lying about it. In this case, the media really has tried to point out that his definition of income isn’t the one most people are familiar with. We’ve had fact-checks about this topic for three years. But Biden just keeps making the same misleading claims over and over.

Read the full article here