Finance

LARRY KUDLOW: Jay Powell is right to keep his pedal off the accelerator

Here we go again. It’s the most important one-man show on Broadway. It opens, and then re-opens six or seven times a year, and the star of the show — Fed Chair Jay Powell plays himself.

The great thing about these Powell performances is they’re like warshock tests. You can read anything into them you want. Wall Street spends untold sums hiring analysts who try to interpret Mr. Powell. Investors are undoubtedly baffled by all of this.

After today’s performance, the stock market went up 400 points or so, so investors are happy out there. Now, are they happy because the Fed leaned against the wind and suggested no easier money? That Mr. Powell is going to hold the line with his 2% inflation target? Or that the Fed is not going to start slashing rates in order to juice the economy to re-elect Joe Biden? Who knows?

MORTGAGE RATES TO STAY ABOVE 6% THROUGH 2025, FANNIE MAE SAYS

Others will say the Fed economic projections still show three interest rate cuts this year, even though their projections are nearly always wrong. I think the best thing Powell said was keeping his 2% inflation target and not raise it to 3%, and in fact, they’re not there yet.

Here’s some price-level indicators everybody should keep an eye on, including the Fed. The gold price since October is up 20%. A key commodity index since November, up 12%. Brent crude oil at $86, is up 19% since mid-December. Gasoline at the pump has climbed 12% back to $3.52.

In the Treasury market, most interest rates have gone up since the last Fed meeting in January. The actual inflation reports in the last three months have shown higher, not lower, inflation trends. So, Mr. Powell is right to stay cautious and not embark on some wild monetary pump-priming, and interest rate-cutting eruption.

By the way, in a recent report, former Treasury Secretary Larry Summers has reconstructed the old CPI from the ’70s and ’80s that included personal borrowing costs, such as mortgage, auto and credit card loans. For some reason, these costs were removed from the Consumer Price Index at some point during the mid- to late-1990s, but one reason why Joe Biden has a rock-bottom economic approval rating, and consumer sentiment is so low, is because car loans are running around 10%, credit card loans upwards of 25% and mortgage rates stubbornly above 7%.

This is causing great consumer unhappiness, even though the experts removed these personal interest rate costs from the inflation indexes. Summers reconstructed the CPI and came up with an 18% inflation peak back in April 2022 and a 7% inflation rate as recently as November 2023. So, the story is even worse.

The official CPI was 3.2% over the year ending in February, even though since the beginning of Joe Biden’s term the price level has gone up over 18% with groceries up 21% and energy up 30%. So, with all this, Jay Powell is right to keep his pedal off the accelerator, but remember folks, even on Broadway, there’s no such thing as a one-act play.

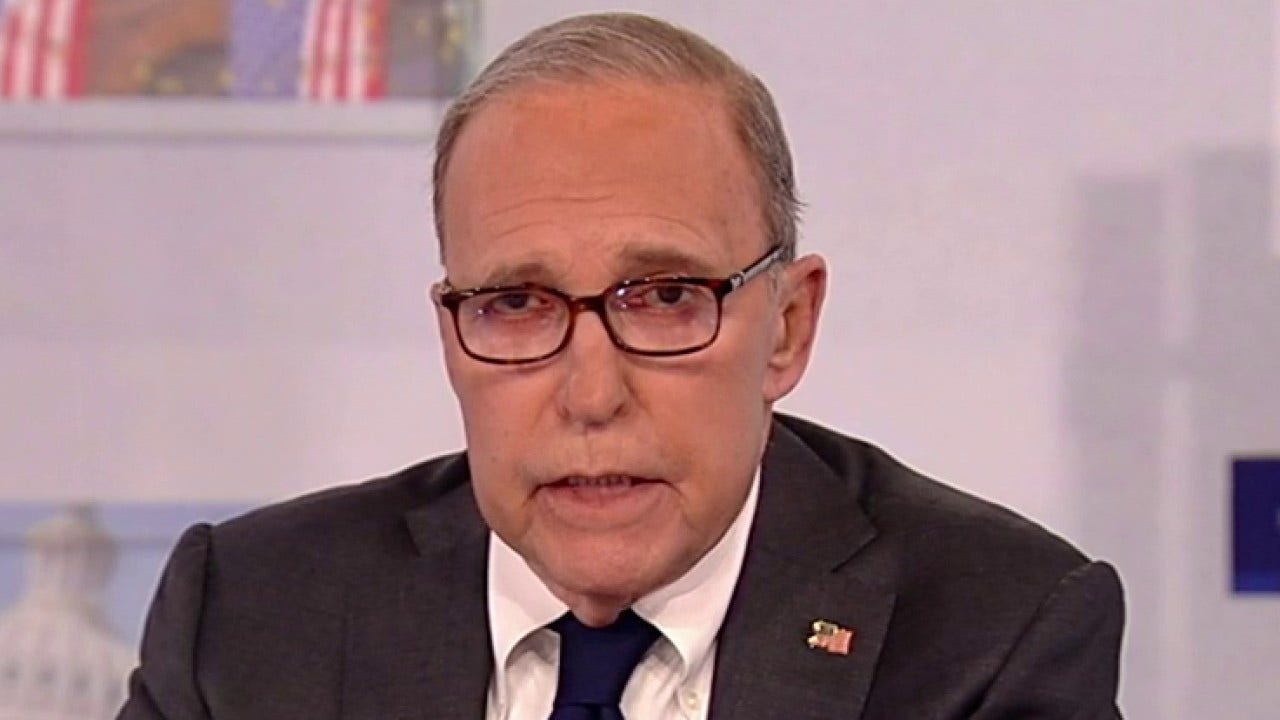

This article is adapted from Larry Kudlow’s opening commentary on the March 20, 2024, edition of “Kudlow.”

Read the full article here