Politics

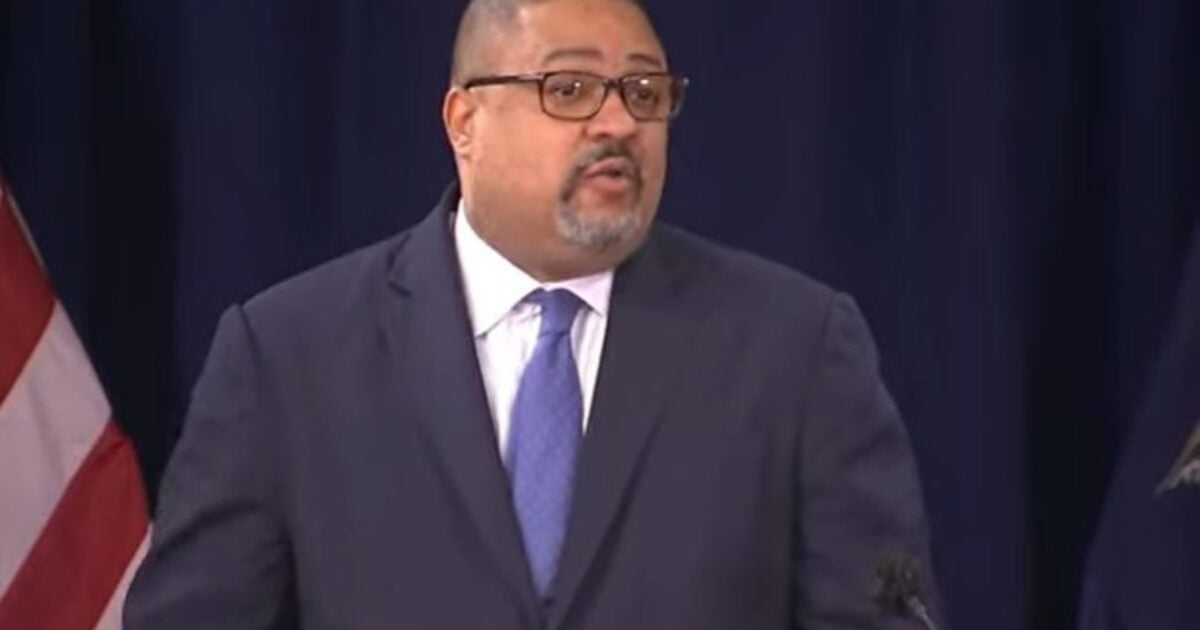

Alvin Bragg Files for Delay in Trump’s New York City Trial

Manhattan District Attorney Alvin Bragg filed for a delay of up to thirty days in the trial of President Trump over charges related to an alleged hush money payment to stripper Stormy Daniels, aka Stephanie Clifford. Jury selection in the case was scheduled to start on March 25. Bragg charged Trump last April with 34 counts of Falsifying Business Records in the First Degree. Each count has a 4 year maximum sentence.

File screen image.

Bragg said the U.S. Attorney’s Office had just provided about 31,000 pages of documents to the defense and prosecution on Wednesday, saying he would need up to a month review the documents. Bragg blamed Trump for the delay.

Text from Bragg’s filing:

Defendant has moved for an adjournment or dismissal based on claimed discovery violations, and also seeks to adjourn the start of trial by 90 days because of the production since March 4, 2024 of approximately 73,000 pages of records by the United States Attorney’s Office. These records were produced in response to defendant’s January 18, 2024 subpoena to that office. The People’s opposition to defendant’s motion is currently due tomorrow, March 15. The People’s opposition will set out in detail our full compliance with Article 245 throughout the discovery process in this case.

We submit this notice in advance of that opposition to advise the Court of additional developments yesterday, after defendant filed his motion and after the People submitted our onepage letter response. Specifically, yesterday the USAO produced approximately 31,000 pages of

additional records and represented that there will be another production of documents by next week. Based on our initial review of yesterday’s production, those records appear to contain materials related to the subject matter of this case, including materials that the People requested from the USAO more than a year ago and that the USAO previously declined to provide. These developments do not affect the People’s compliance with all obligations under Article 245 and certainly do not warrant dismissal, and the People are ready for trial on March 25. Nonetheless, in light of the distinctive circumstances described below, the People do not oppose a brief adjournment of up to 30 days to permit sufficient time for defendant to review the USAO productions.Regarding the 73,000 pages of records produced by the USAO as of the date of defendant’s motion, the People’s initial review indicated that those materials were largely irrelevant to the subject matter of this case, with the exception of approximately 172 pages of witness statements that defendant would have adequate time to review and address before trial. Yesterday afternoon, however, the USAO produced approximately 31,000 pages of additional records to both the People and the defense in response to defendant’s subpoena, and also indicated that an additional production would follow by next week.

We note that the timing of the current production of additional materials from the USAO is a function of defendant’s own delay. The People diligently sought the full grand jury record related to Cohen’s campaign finance convictions from the USAO last year, including exculpatory

material and (1) grand jury minutes and tapes; (2) witness lists and other documents identifying the names or identities of grand jury witnesses; (3) any grand jury subpoenas and documents returned pursuant to those subpoenas; (4) exhibits presented to the grand jury; (5) to the extent within the scope of Rule 6(e), summaries of witness interviews occurring outside the grand jury; and (6) to the extent within the scope of Rule 6(e), search warrant affidavits or other applications that contain evidence from the grand jury, and evidence seized pursuant to those warrants. In response, the USAO produced a subset of the materials we requested, which we timely and fully disclosed to defendant on June 8, 2023, more than nine months ago. Despite having access to those materials since June, defendant raised no concerns to the People about the sufficiency of our efforts to obtain materials from the USAO before last week; instead, defendant waited until January 18, 2024 to subpoena additional materials from the USAO and then consented to repeated extensions of the deadline for the USAO’s determination. The timing of the USAO’s productions is a result solely of defendant’s delay despite the People’s diligence.Nonetheless, and although the People are prepared to proceed to trial on March 25, we do not oppose an adjournment in an abundance of caution and to ensure that defendant has sufficient time to review the new materials. We therefore notify the Court that we do not oppose a brief adjournment not to exceed 30 days, notwithstanding the People’s compliance with all of our obligations under Article 245. We also request an extension from Friday, March 15 to Monday, March 18 for the People to file our full response to defendant’s discovery motion, in order to permit us to fully address intervening developments since the date of defendant’s motion. We submit this notice before filing our opposition to defendant’s motion to make the Court aware of yesterday’s developments as promptly as possible and to permit the Court to consider how to proceed. We are available for a conference with the Court if the Court requests.

Excerpt from Bragg’s press release dated April 4, 2023 announcing the charges against Trump.

Manhattan District Attorney Alvin L. Bragg, Jr. today announced the indictment of DONALD J. TRUMP, 76, for falsifying New York business records in order to conceal damaging information and unlawful activity from American voters before and after the 2016 election. During the election, TRUMP and others employed a “catch and kill” scheme to identify, purchase, and bury negative information about him and boost his electoral prospects. TRUMP then went to great lengths to hide this conduct, causing dozens of false entries in business records to conceal criminal activity, including attempts to violate state and federal election laws.

TRUMP is charged in a New York State Supreme Court indictment with 34 counts of Falsifying Business Records in the First Degree.[]

“The People of the State of New York allege that Donald J. Trump repeatedly and fraudulently falsified New York business records to conceal crimes that hid damaging information from the voting public during the 2016 presidential election,” said District Attorney Bragg. “Manhattan is home to the country’s most significant business market. We cannot allow New York businesses to manipulate their records to cover up criminal conduct. As the Statement of Facts describes, the trail of money and lies exposes a pattern that, the People allege, violates one of New York’s basic and fundamental business laws. As this office has done time and time again, we today uphold our solemn responsibility to ensure that everyone stands equal before the law.”

According to court documents and statements made on the record in court, from August 2015 to December 2017, TRUMP orchestrated his “catch and kill” scheme through a series of payments that he then concealed through months of false business entries.

…In a third instance – 12 days before the presidential general election – the Special Counsel wired $130,000 to an attorney for an adult film actress. The Special Counsel, who has since pleaded guilty and served time in prison for making the illegal campaign contribution, made the payment through a shell corporation funded through a bank in Manhattan.

After winning the election, TRUMP reimbursed the Special Counsel through a series of monthly checks, first from the Donald J. Trump Revocable Trust – created in New York to hold the Trump Organization’s assets during TRUMP’s presidency – and later from TRUMP’s bank account. In total, 11 checks were issued for a phony purpose. Nine of those checks were signed by TRUMP. Each check was processed by the Trump Organization and illegally disguised as a payment for legal services rendered pursuant to a non-existent retainer agreement. In total, 34 false entries were made in New York business records to conceal the initial covert $130,000 payment. Further, participants in the scheme took steps that mischaracterized, for tax purposes, the true nature of the reimbursements.

Read the full article here