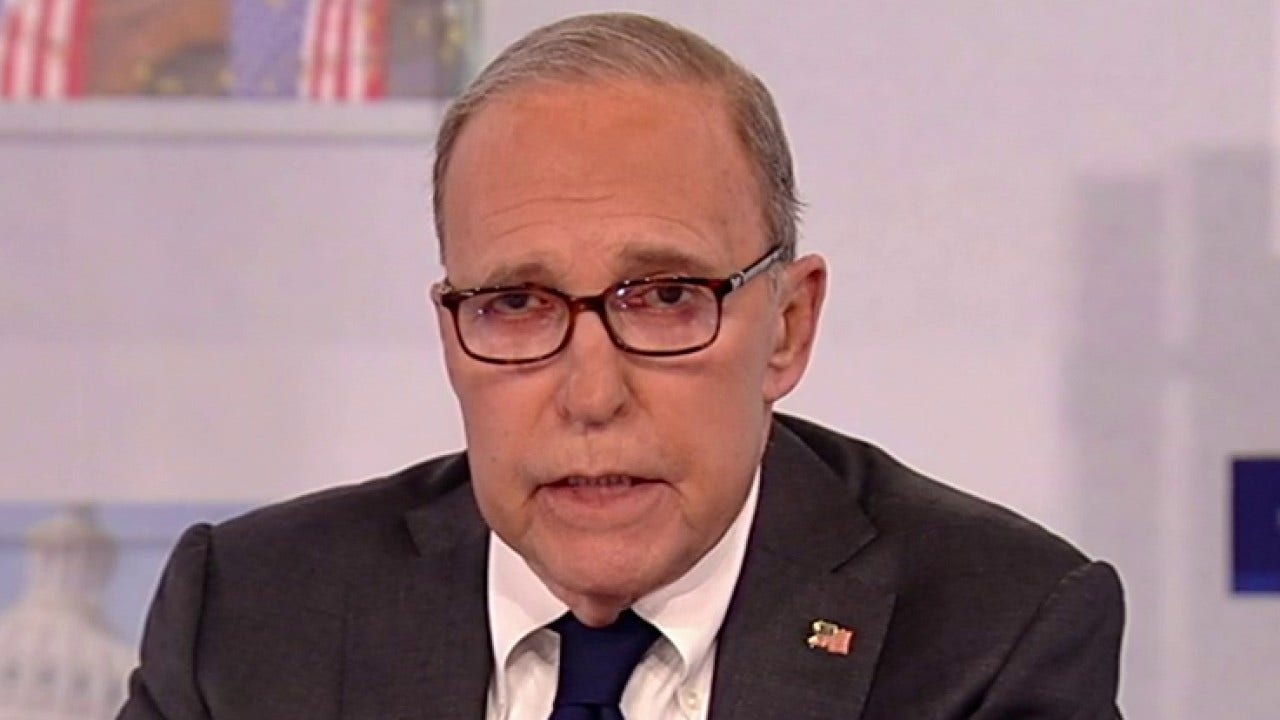

Finance

LARRY KUDLOW: Cutting benefits and raising taxes from another fiscal commission would be fiscal insanity

Here’s a very bad idea: something called a “fiscal commission” coming out of Washington. For some reason, there are some Republicans – like Texas Congressman Jodey Arrington, head of the House Budget Committee – that are looking to get hoodwinked and are pushing to get this through. It’s an absolutely terrible idea. It’s a tax trap.

We’ve had these goofy commissions down through the years. Paul Ryan chaired one that raised taxes and damaged the economy. Then, there was Simpson-Bowles that was never implemented but would’ve raised taxes significantly.

Going way back, President George H.W. Bush agreed to a tax hike in the 1990 budget summit that probably cost him the 1992 election. The Congressional Budget Office projected that the tax hikes would yield $159 billion of new revenue, but lose $206 billion from economic damage inflicted by higher taxes – for a net loss of $47 billion.

STUART VARNEY: TRUMP IS STORMING THROUGH ELECTION SEASON; BIDEN IS ABSENT IN NEW HAMPSHIRE

It didn’t help the deficit at all. Bill Clinton raised taxes in 1993, but CBO estimates later on showed the weaker economy lost almost all of the projected revenue increase.

Barack Obama raised taxes in 2010 and 2013. Then, later, the CBO showed a nearly $4 trillion revenue loss because of a falling economy. Clinton wised up in 1996 and 1997 by cutting taxes and reforming welfare and the deficit disappeared for four years with real growth – a massive 4.5% gain per year.

Hat tip to former Texas Congressman Jeb Hensarling for his excellent op-ed piece on this subject last week in the Wall Street Journal: “The best way to avert a crisis is to reform entitlements. The next best way is growth.” The trouble with these so-called bipartisan commissions is that they start raising taxes at the very first meeting, even before the first cup of coffee has been poured.

Whether it was JFK in the 1960s, Ronald Reagan in the 1980s, Bill Clinton in his second term, or Donald Trump – lower taxes have always been a successful policy ingredient to boosting economic growth and more growth, with more people working, with higher wages, generates more tax revenues to lower deficits by a factor of at least two- or three-to-one.

That’s the historical evidence and Republicans should not be lulled into falling for yet another phony fiscal commission. Better to give President Trump a strong Republican Senate and House, so that the fiscal committees can do their job, rather than rely on left-wing Democrats and, finally, any moves to strengthen Social Security should focus on market-based investment choice.

Just like the federal Thrift Savings Plan, Social Security participants should have the option of purchasing approved stock or bond index funds that, over the long run, will yield far higher returns and create more wealth than the current system, which invests only in Treasury bills. Just like private retirement accounts, Social Security should create more wealth for more people over the longer run. Cutting benefits and raising taxes from another fiscal commission would be nothing but more fiscal insanity.

This article is adapted from Larry Kudlow’s opening commentary on the January 22, 2024, edition of “Kudlow.”

Read the full article here