Finance

Biden announces ‘alternative path to debt relief’ after SCOTUS blocks student loan handout

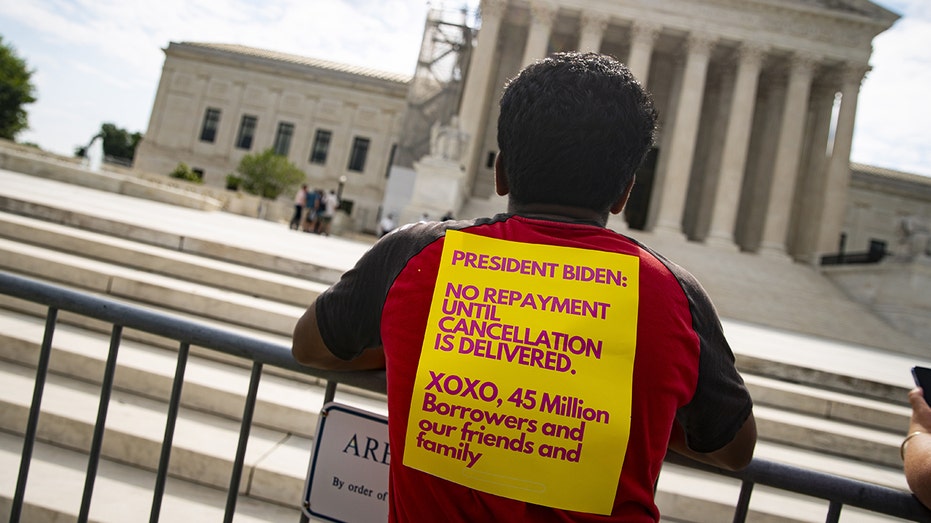

President Biden on Friday announced a new effort at providing “debt relief” for as many student loan borrowers as possible after the Supreme Court blocked his handout plan.

While harshly criticizing Republicans for “snatching” a student loan handout from the “hands of millions of Americans,” Biden said that the Department of Education initiated rulemaking using the secretary’s authority under the Higher Education Act.

“Today, the Department initiated rulemaking aimed at opening an alternative path to debt relief for as many borrowers as possible, using the Secretary of Education’s authority under the Higher Education Act. The Department issued a notice, which is the first step in the process of issuing new regulations under this so-called ‘negotiated rulemaking’ process. The notice announces a virtual public hearing on July 18th and solicits written comments from stakeholders on topics to consider,” a press release from the White House states.

The White House didn’t elaborate on specifics, but said that the Department of Education would “complete this rulemaking as quickly as possible.”

BIDEN SAYS SCOTUS ‘MISINTERPRETED THE CONSTITUTION’ AFTER BLOCKING STUDENT LOAN HANDOUT, HITS REPUBLICANS

Biden also said that under the new income-driven repayment plan, called the “Saving on a Valuable Education (SAVE) plan,” borrowers will not pay more than 5% of their disposable income. His comments come after the Supreme Court ruled on Friday morning that the Biden administration’s planned student loan handout program cannot move forward.

The White House also said that a temporary “on-ramp” will be created “to protect borrowers from the harshest consequences of late, missed, or partial payments for up to 12 months.”

“While payments will be due and interest will accrue during this period, interest will not capitalize at the end of the on-ramp period. Additionally, borrowers will not be reported to credit bureaus, be considered in default, or referred to collection agencies for late, missed, or partial payments during the on-ramp period. Future monthly bills for borrowers not enrolled in an income-driven repayment plan will be automatically adjusted to reflect the accrued interest during those months,” the White House said.

SUPREME COURT RULES AGAINST BIDEN STUDENT LOAN DEBT HANDOUT

The 6-3 Supreme Court decision issued on Friday held that the secretary of education isn’t permitted to cancel more than $430 billion in student loan debt under federal law.

“The Secretary’s plan canceled roughly $430 billion of federal student loan balances, completely erasing the debts of 20 million borrowers and lowering the median amount owed by the other 23 million from $29,400 to $13,600,” Chief Justice John Roberts wrote for the majority opinion. “Six States sued, arguing that the HEROES Act does not authorize the loan cancelation plan. We agree.”

Biden’s student loan handout plan would have canceled up to $20,000 in student loan debt for Pell Grant recipients in college and up to $10,000 for others who borrowed using federal student loans.

Fox News’ Anders Hagstrom, Chris Pandolfo, Bill Mears and Shannon Bream contributed to this report.

Read the full article here