Finance

DOJ announces latest payouts to Bernie Madoff Ponzi scheme victims totaling nearly $159M

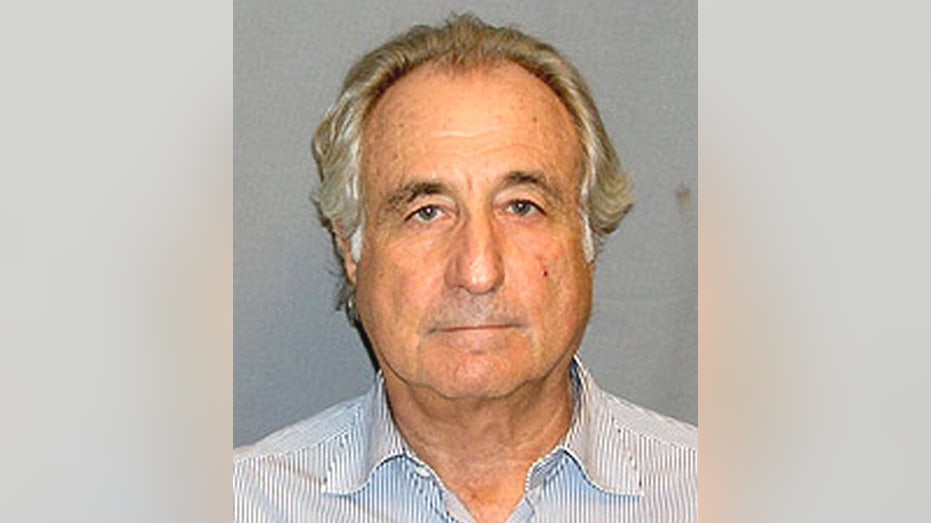

The Justice Department announced on Monday the latest payouts to be distributed to nearly 25,000 victims of Bernie Madoff’s infamous Ponzi scheme.

This comes through the Madoff Victim Fund’s (MVF) ninth distribution of over $158.9 million in funds forfeited to the U.S. government in connection with the Bernard L. Madoff Investment Securities LLC (BLMIS) fraud scheme.

In this distribution, payments will be sent to 24,875 victims across the globe, bringing their total recoveries to 91% of their fraud losses, according to the DOJ. Through its nine distributions, MVF has paid over $4.22 billion to 40,843 victims as compensation for losses they suffered from the collapse of BLMIS. Madoff himself died at the Federal Medical Center in Butner, North Carolina, on April 14, 2021, at age 82.

“The department’s Madoff Victim Fund has exceeded expectations in the level of recovery provided to victims of the fraud committed by Bernard Madoff, which devastated thousands of lives,” Acting Assistant Attorney General Nicole M. Argentieri of the Justice Department’s Criminal Division said in a statement. “To date, the Madoff Victim Fund has assisted more than 40,800 individual victims in recovering over 90% of victim losses. The department continues to prioritize the use of civil asset forfeiture to ensure compensation is available for victims of fraud.”

BERNIE MADOFF: INSIDE THE LIFE AND DEATH OF THE ‘SNAKE OIL SALESMAN’

A decadeslong force on Wall Street, Madoff shocked the world when he was charged in 2009 in the Southern District of New York for a $64 billion securities fraud Ponzi scheme, which U.S. Attorney Damian Williams stressed Monday was “one of the most prolific financial crimes in American history” at the time.

The scheme began in the early 1970s, and by the time Madoff was arrested in December 2008, it had defrauded as many as 37,000 people in 136 countries out of up to $65 billion. Prosecutors said Madoff swindled thousands of ordinary investors out of their life savings through a scheme exposed during the 2008 stock market crash, when millions of homeowners suddenly needed their money out of the stock market to pay for their mortgages. Madoff had built a reputation as a brilliant stock selector who was also sought after by the wealthy elite, and his famous victims included film director Steven Spielberg, actor Kevin Bacon and Nobel Peace Prize winner Elie Weisel.

“Among Madoff’s many victims were not only wealthy and institutional investors, but charities and pension funds alike – some of which invested money with Madoff on behalf of individuals working paycheck-to-paycheck who were relying on their pension accounts for their retirements,” Williams said in a statement. “The financial toll on those who entrusted their money with Madoff was devasting, and this office’s unprecedented efforts to return money to Madoff’s victims has now resulted in clawbacks of 91% of fraud losses to their rightful owners. I commend the career prosecutors of this office for today’s distribution of over $158 million and for their relentless pursuit of justice for victims of Wall Street fraudsters, like Bernie Madoff.”

BERNIE MADOFF, MASTERMIND OF VAST PONZI SCHEME, DIES IN FEDERAL PRISON AT AGE 82

For decades, Madoff used his position as chairman of BLMIS, the investment advisory business he founded in 1960, to steal billions of dollars from his clients, according to court documents. On March 12, 2009, Madoff pleaded guilty to 11 federal felonies, admitting that he had turned his wealth management business into the world’s largest Ponzi scheme, benefiting himself, his family and select members of his inner circle, the Justice Department said.

On June 29, 2009, Madoff was sentenced to 150 years in prison. Of the over $4 billion that has been made available to victims, approximately $2.2 billion was collected as part of the historic civil forfeiture recovery from the estate of deceased Madoff investor Jeffry Picower. An additional $1.7 billion was collected as part of a deferred prosecution agreement with JPMorgan Chase Bank N.A. and civilly forfeited in a parallel action. The remaining funds were collected through a civil forfeiture action against investor Carl Shapiro and his family, and from civil and criminal forfeiture actions against Madoff, Peter B. Madoff, and their co-conspirators.

The MVF is overseen by Richard Breeden, former chairman of the U.S. Securities and Exchange Commission, who serves as Special Master appointed by the Justice Department to assist in connection with the victim remission proceedings. Breeden and his team at MVF provided essential assistance to evaluate over 68,000 remission petitions involving billions in cash flows, and to compute each victim’s fraud losses to enable payments to be made.

Fox Business’ Joshua Q. Nelson contributed to this report.

Read the full article here