Finance

Credit counseling service sees huge surge in calls during holiday shopping kickoff

While a record-breaking number of Americans engaged in shopping over the Thanksgiving holiday weekend, nonprofit financial counselors also saw a significant increase in requests for debt counseling during the holiday shopping season kick-off.

Money Management International (MMI), one of the largest non-profit credit counseling agencies in the U.S., says it received a 44% year-over-year increase in the number of consumers seeking its services during the week of Thanksgiving, and a staggering 80% spike in calls on Cyber Monday.

Thomas Nitzsche, MMI’s senior director for media and brand, told FOX Business the surge of inquiries over the past few weeks is very unusual, because this is typically the time of year that the agency sees a decrease in new clients.

In a typical year, he explained, MMI sees a notable decrease in calls during November and December, with an uptick in January and February as the holiday bills hit and folks set financial resolutions for the new year.

MORE FAMILIES LOST FAITH IN ‘AMERICAN DREAM’ IN LAST 5 YEARS: STUDY

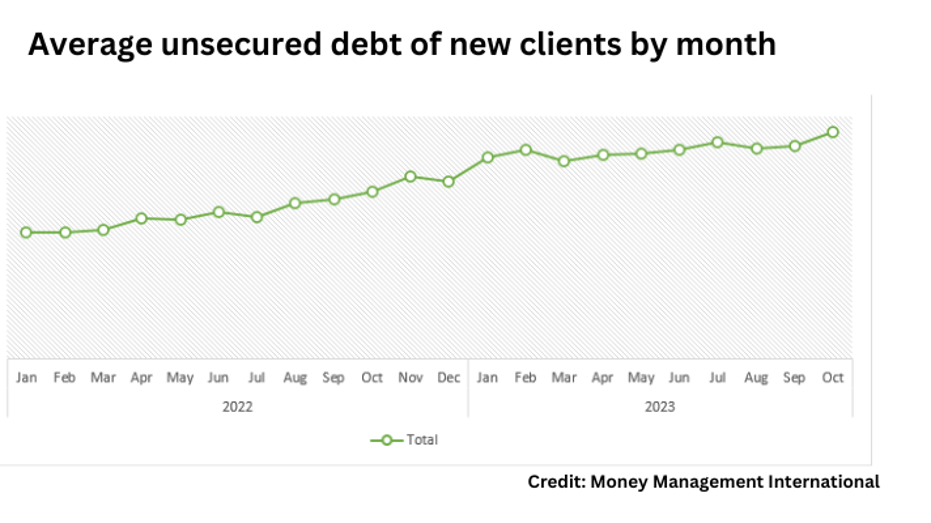

But the recent surge is not entirely surprising, Nitzsche says, pointing out there has also been a steady increase in the number of consumers seeking credit counseling over the last 18 months across almost all age groups. In addition, the average level of total unsecured debt among consumers seeking debt help has also steadily risen from around $20,000 to almost $30,000 during the same time frame.

The number of new clients and level of their unsecured debt also aren’t the only increases MMI is seeing: Non-mortgage secured debt (a vehicle for most people) among new clients is up 11% over last year, now averaging $24,000 while mortgage debt among new clients is up 16% this year over last, now averaging $234,000.

MANY OLDER AMERICANS HAVING DIFFICULTY MANAGING DEBT, AARP SURVEY INDICATES

“We think that a combination of post-pandemic spending, elevated interest rates, and the reality of restarted student loan payments are all catching up with vulnerable consumers… both those who are lower-income and those with little savings who carry significant unsecured debt from month to month,” Nitzche said.

He said a loan balance that used to be manageable with lower interest rates is unmanageable now that rates are so high, and for young people, this is often the first time they have ever experienced higher interest rates.

Although inflation has cooled, he noted, the cost of goods remains high, and salaries haven’t kept up. Housing costs are less volatile than last year, but they’ve still been rising since January and Nitzche believes they will continue to do so as higher interest rates begin to affect more and more multifamily rental properties.

“Slower inflation isn’t providing people with any relief, it’s just preventing some potential additional hardship,” Nitzche said. “Unless the price of goods goes down or salaries increase, this trend is going to continue for a while.”

Read the full article here