Top News

Scraping the bottom of the barrel

More oil news to tie in with the rally in prices I posted about yesterday. Only today, thanks to an article little brother Crusader sent along this morning, I’ve learned something new, and it adds nuance to the oil picture as whole.

The Strategic Petroleum Reserve isn’t the only oil related storage thing we need to be concerned with, although what Biden has done to it in the name of his political capital IS hugely concerning.

There’s also a facility called the Cushing oil hub.

It’s located in Cushing, OK and is considered to be one of the key oil storage hubs for the country, being “the delivery point for U.S. crude futures.”

…Cushing is strategically located to pull in barrels from top U.S. shale fields and Canada, while its hundreds of tanks are tied to pipelines that supply U.S. mid-continent and southern refineries and funnel oil to Gulf Coast export ports.

ES MUY IMPORTANTE

Well, it turns out that a fair amount of the price spikes yesterday were in relation to the state of the storage tanks at Cushing – they’re running on about empty. The industry and markets are quite worried about literally have to scrape the bottom of the barrel.

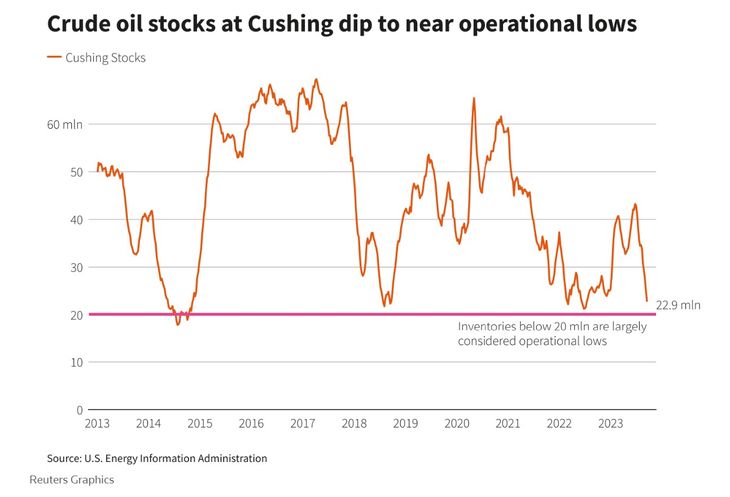

Oil prices reached their highest level in over a year Thursday, after crude stocks at a key storage hub fell to their lowest since July last year.

Crude inventories in Cushing, Oklahoma fell to 22 million barrels in the fourth week of September — hovering close to the operational minimum, according to data from the U.S. Energy Information Administration (EIA). That’s a drop of 943,000 barrels compared to the prior week.

The U.S. West Texas Intermediate futures touched $95.03 per barrel, marking the highest since August 2022. However, they were last trading at $93.23 per barrel. Global benchmark Brent was last down 0.3% at $96.23.

“Today’s price action seems to be Cushing driven, as it reaches a 22 million bbl low, the lowest level since July 2022,” Bart Melek, managing director of TD Securities, told CNBC.

There’s about 98M bbls capacity at Cushing, and it’s been drawn it down to 22M bbls at the moment.

At a level of 20M bbls and below, it becomes a technical problem retrieving what’s left at the bottom of the tanks. That’s if you can get it – or want what it is when you get it – out of the tanks at all.

It also becomes very dangerous.

…Tank storage of below 20 million barrels, or between 10% and 20% of Cushing’s over 98 million barrels of capacity, is considered close to operational low, say traders. Below those levels the oil is difficult to remove.

“If you let the crude (level) drop too low, the crude can get sludgy and you can’t get it out. What does come out – you won’t be able to use,” said Carl Larry, a sales director at energy consultants Wood Mackenzie.

Water and sediments often settle at the base of storage tanks, making the crude oil at the bottom unable to meet quality standards for refiners or exporters.

Some tanks have outlets at the bottom that can be used to empty oil and sludge completely, while others do not and therefore the oil at the base cannot be removed completely. At lower levels, it becomes more expensive for companies to get the remaining crude out of the tanks.

Roofs of storage tanks also float on the oil, preventing vapors from building up or escaping into the atmosphere. When the legs of these roofs touch the base, it creates a gap between the oil and the roof, causing combustible vapors to form.

Refiners have been running at full bore, which has been drawing crude out of Cushing as quickly as its being piped into the tanks. There is some concern for even more pressure on oil pricing as we get into refinery maintenance season. They’ll be shutting down large parts of refineries to catch up on required maintenance and do seasonal blend change-overs. Normally that would give the tanks at Cushing a little breathing room to refill on reduced demand. But with the money the refiners are making right now, analysts believe they are going to hustle through the maintenance cycles, and get back to pumping out as much product as they can as quickly as possible.

So the pressure stays on Cushing to keep sending along the crude – which, thanks to higher prices, might now come from somewhere else – and prices remain elevated.

…Typically, when Cushing inventories drop, relative prices at the hub increase to attract barrels from the Permian and limit outflows to the Gulf Coast, said Lee Williams, a senior analyst at Wood Mackenzie.

Alternatively, pipeline or storage terminal operators may limit outflows for operational purposes as inventories near the floor, said Williams.

Industry analyst are using the adjective “robust” to describe the oil deficit facing the world going forward, which, of course, doesn’t bode well for anyone’s wallet or energy security.

…The global oil markets are looking at a “pretty robust deficit” on top of an already significant shortfall this quarter, Malek said, citing the oil production cuts implemented by OPEC and its allies.

…“OPEC+ production cuts, including the voluntary extra cut by Saudi Arabia, are bearing fruit, lowering oil inventories and supporting prices,” UBS wrote in a note dated September 28.

Awesomesauce. Not to mention, during the last drawdown at Cushing, the U.S. was not an oil exporter, by statute.

We sure are now. And there’s no slack in the system in case we have a rainy day our ownselves, with our exploration and new drilling at a standstill to boot.

…Now with high export demand, market participants worry that draws at Cushing will continue.

“The world is hungry for crude,” said Ernie Barsamian, CEO of the Tank Tiger, a U.S. terminal storage clearinghouse. “Any incremental production will get exported.”

#Bidenomics

There just isn’t enough bad you can say about it.

Read the full article here